Accept Credit Cards At 0% Cost & Increase Your Margins Instantly.*

Eliminate Credit Card Processing Fees With Surcharging

Zero Fees Processing specializes in providing payment processing solutions that can help your business save on expenses. As the leading merchant processing service provider we offer payment gateways, point of sale (POS) systems, and e-commerce support services. We’re dedicated to helping small medium businesses optimize their transactions and improve their bottom line for greater financial stability.

Unlock Zero Fees Processing – Start Saving Today with Our Risk-Free Trial!

30-Day Free Trial: Experience the benefits of Zero Fees Processing with no commitment. Enjoy a full month of transaction savings on us!

No Setup Fees: We’ll waive all setup costs, so you can start saving from day one.

Money-Back Guarantee: If you’re not 100% satisfied with the results, cancel anytime within the first 30 days and pay nothing.

Dedicated Support: Our team will work with you to optimize your setup, ensure compliance, and help you communicate the benefits to your customers.

Zero Fees Processing Equipment

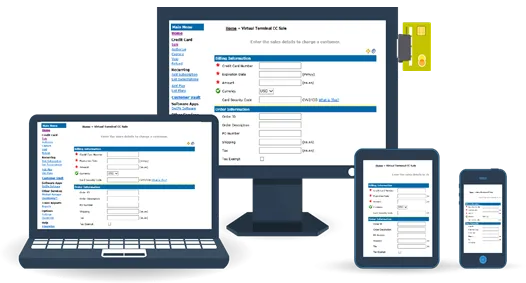

Virtual Terminal

Integrates with Existing Software

POS Systems

Great for Shops and Retailers

Mobile POS

For Service Providers on the Go

Industries That Benefit from Zero Fees Processing

Retail & E-Commerce

Retail stores, both online and in-store, handle a large number of credit card transactions. Zero Fees Processing helps retailers cut costs without raising prices, keeping their offerings competitive while maximizing profit .

Auto Services & Repair Shops

Auto repair shops process many card payments daily. Zero Fees Processing lets them avoid transaction fees, helping increase profits and allowing for reinvestment in tools, equipment, and customer service.

Restaurants & Food Services

From small cafes to full-service restaurants, food service providers benefit by cutting down on processing fees, especially with increasing costs in the industry. This lets them maintain menu prices while improving cash flow.

Professional Services

Industries like law, accounting, and consulting see high transaction volumes. Zero Fees Processing helps these businesses reduce overhead costs, providing a reliable and steady revenue flow.

Health & Wellness

From gyms to chiropractic clinics, health and wellness providers handle frequent transactions. Zero Fees Processing helps these businesses increase operational savings, ensuring more budget for quality services and facilities.

Home Improvement Services

Businesses like landscaping, plumbing, and contracting often see large, one-time transactions. Zero Fees Processing helps retain a larger share of these payments, supporting operational needs and growth.

Businesses can Accept Credit Cards for 0%

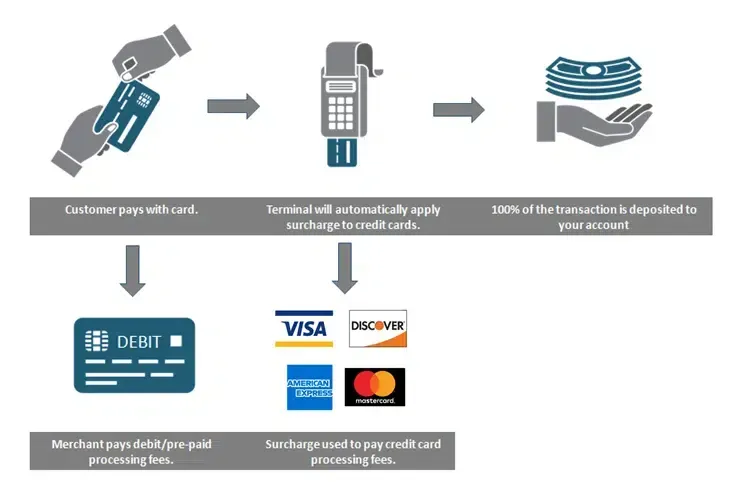

How does no-fee credit card processing work?

When a merchant sets up a credit card processing solution, physical and online terminals need to be programmed to process these payments. No-fee payment processing requires these terminals to be programmed to add a markup on the purchase which covers the credit card processing fees for that particular transaction.

Surcharge or Service Fee: When a customer pays with a credit or debit card, a surcharge or service fee is added to the transaction. This fee covers the payment processing cost that the business would typically pay.

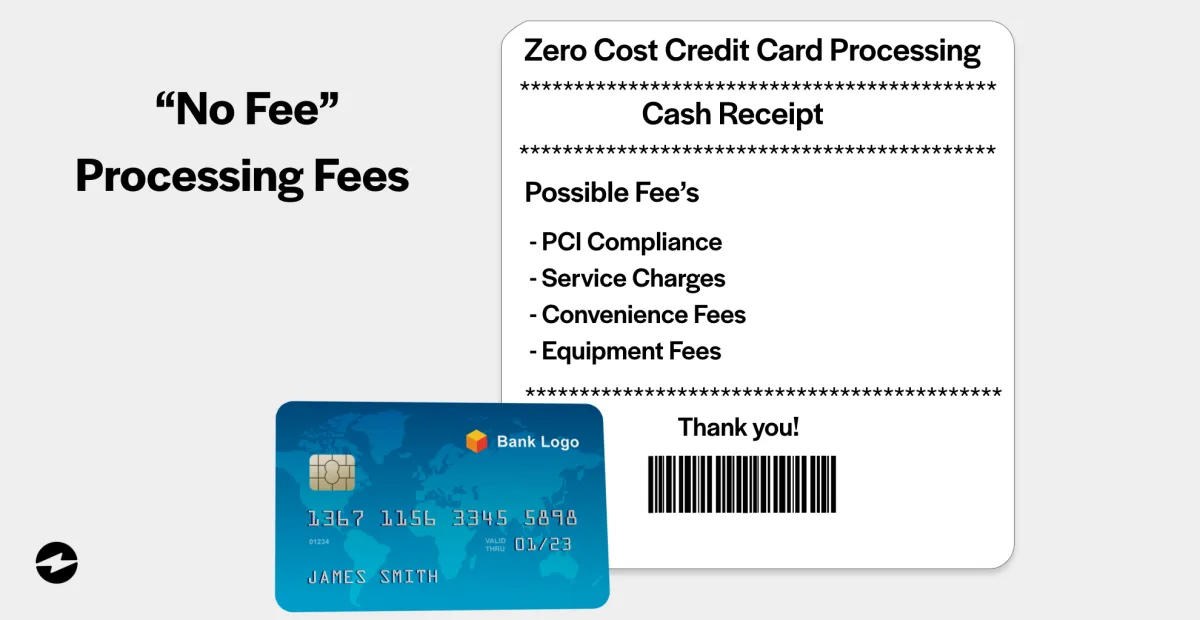

Legal Compliance: Zero Fees Processing programs must comply with regulations, as laws on surcharging vary by country and state. In the U.S., for example, surcharging is allowed in most states but must be clearly disclosed to customers at the point of sale.

Cash Discount Option: To encourage customers to pay by cash (or other non-fee-incurring methods), businesses sometimes offer a cash discount, allowing customers to avoid the added fee if they pay with cash.

Limited Time Offer: 100% Compliant Surcharging Solution

Pay No Fee to Accept Credit Cards

Waiving Sign up fee ($199) value

Free hosted payment page to take secure online payments

Free virtual terminal to take payments over the phone

We’ll Help You Make More Of It

See How Much Your Business Can Save with

Zero-Fee Payment Processing

Small Business: A business processing $100,000 annually could save between $1,500 and $3,500 each year by adopting zero-fee processing.

Medium-Sized Business: With annual transactions totaling $500,000, potential savings range from $7,500 to $17,500.

Large Business: A company processing $1 million annually might save between $15,000 and $35,000.

14%

Approximately 14% of U.S. merchants have implemented zero-fee processing

69%

of U.S. consumers have encountered additional charges when paying with credit cards, suggesting widespread implementation of surcharging practices.

48 States

As of 2024, surcharging credit card transactions is permitted in 48 states, with Connecticut and Massachusetts prohibiting the practice..

What Our Clients Are Saying

Real Success Stories from Businesses Thriving with

Zero Fees Processing

Switching to zero-fee processing has been a game-changer for our auto service shop. We used to lose thousands of dollars a year to credit card fees, but now we’re able to put that money right back into growing our business. Our customers appreciate the transparency, and many have even started using cash more often to save on fees. We've saved over $10,000 this year alone – it's the best decision we've made for our bottom line!

★★★★★

Mike R., Owner of Precision Auto Services

Implementing zero-fee processing was a no-brainer for us. As a retail auto service provider, we handle a high volume of card transactions daily. With this model, we’ve been able to eliminate fees that used to eat into our profits, saving us over $15,000 in just six months. It’s allowed us to keep our rates competitive and invest more in customer service. Our clients understand the small surcharge, and it’s given us the financial boost we needed to expand our offerings.

★★★★★

Lisa T., Manager at QuickFix Auto Center

Frequently Asked Questions about Zero Fees Processing

Get Answers to Common Questions and Learn How Zero Fees Processing Can Benefit Your Business

What is zero fee processing?

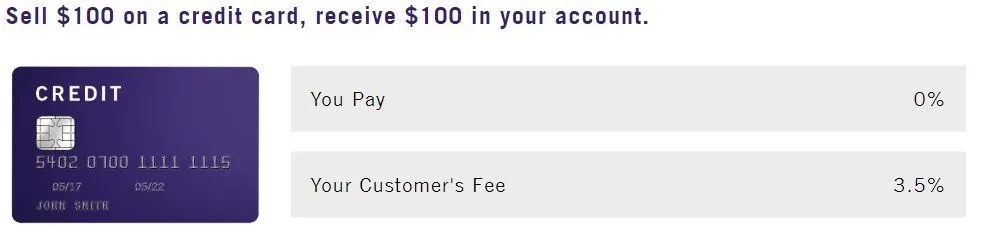

Zero Fees Processing is a payment model where the transaction fees normally charged to a merchant are passed to the customer, meaning the business effectively pays zero fees for credit card transactions. This helps businesses save on processing costs and improve profit margins.

How does Zero Fees Processing work?

When a customer pays with a credit or debit card, a small fee is added to their transaction, covering the typical processing costs. Merchants are able to retain 100% of their sales revenue, as they no longer pay these fees.

Is Zero Fees Processing legal?

Yes, Zero Fees Processing is legal in most U.S. states, but specific rules apply. It’s important to disclose any fees to customers transparently at the point of sale. We stay up-to-date on compliance to ensure you follow local regulations.

How will Zero Fees Processing impact my customers?

Customers may notice a small fee added to their card transactions. Many customers are accustomed to this practice in various industries and appreciate that it allows businesses to keep prices competitive. Offering a cash payment option with no fees can help accommodate customer preferences.

What types of businesses can benefit from Zero Fees Processing?

Any business that processes a high volume of credit or debit card transactions can benefit, especially service-based businesses, retail stores, and auto service providers. It’s particularly useful for businesses looking to reduce operational costs without raising prices.

Do customers have to pay the surcharge if they pay with cash?

No, customers who pay with cash or other non-card methods typically avoid the surcharge, which encourages cash payments and helps you avoid processing fees.

How much can I save with Zero Fees Processing?

Businesses can save anywhere from 1.5% to 3.5% of total transaction volume, depending on typical processing rates. For example, a business processing $500,000 annually could save between $7,500 and $17,500.

How does Zero Fees Processing affect my pricing structure?

With Zero Fees Processing, you don’t need to adjust your product or service prices to cover transaction costs. The processing fee is handled separately, meaning you can keep your prices competitive.

How can I get started with Zero Fees Processing?

Getting started is simple. Reach out to our team, and we’ll set up the Zero Fees Processing model tailored to your business. We handle all implementation details and ensure compliance with legal requirements.

What if customers have questions about the surcharge?

We recommend informing your customers upfront about the surcharge and its benefits to your business. Customers often appreciate the transparency, especially when it helps keep overall prices low.

What credit cards are accepted?

With Zero Fees Processing, you can accept all major credit cards, including Visa, MasterCard, American Express, and Discover. This allows you to serve a wide range of customers without restrictions on card types.

Can this be used with ACH processing?

Yes, Zero Fees Processing can be combined with ACH processing. ACH (Automated Clearing House) transactions often have lower fees than credit card processing, so you may not need a surcharge. However, it’s possible to implement both options to cover all customer payment preferences.

What type of disclaimer do I need to use to inform my customers?

To comply with legal requirements, you must clearly display a disclaimer informing customers of the surcharge or service fee. This disclaimer should be visible at the point of sale, both online and in-store, stating that a small fee applies to credit or debit card transactions. Our team can help you create compliant signage or messaging.

What is payment processing?

Payment processing refers to the steps involved in completing a customer’s payment transaction with your business. It includes authorization, data transfer, and settlement of funds from the customer’s credit card or bank to your account. Zero Fees Processing is a payment model designed to reduce or eliminate the costs typically associated with processing payments.

How long does it take to update my payment processing to Zero Fees?

The transition to Zero Fees Processing is usually quick, often taking just a few days to complete. Once you reach out to our team, we will guide you through the setup process and ensure you’re fully operational with Zero Fees Processing in as little as 24-72 hours.

© 2024 Pegasus Global - All Rights Reserved, All trademarks, logos and brand names are the property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, trademarks and brands does not imply endorsement.